Coupdays (PQL)

Coupdays (PQL)

Returns the number of days in the coupon period that contains the settlement date.

- Returned Output: Numeric

- Library: PQL \ Common \ Financial

- Version: 2025.01.000

- Compatibility:

- It can be combined with other PQL functions throughout the application.

- It CANNOT be used with MDX or VBA functions. But it can be used on MDX-based content in other parts of the application.

Syntax

* Click on the function's arguments above for more details on the input values.

Comments

This function is the same as the Microsoft Excel 'COUPDAYS' function - using the same inputs, logic, and outputs.

Function Arguments

|

Name |

Description |

Type |

Optional |

|---|---|---|---|

|

settlement |

Settlement date for the security. |

String or Number (<Date>) |

|

|

maturity |

Maturity date for the security. |

String or Number (<Date>) |

|

|

frequency |

Frequency of payment, number of coupon payments per year; must be 1, 2, or 4. |

<Numeric> |

|

|

basis |

Integer representing the basis for day count. |

<Numeric> |

Y |

Note: Literal encoding is in use; this means that Booleans and Dates are represented as numeric values (1 and 0 and timestamps or serial date numbers, respectively).

Example

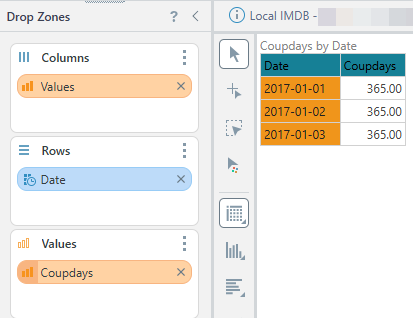

This example calculates the total number of days in the current coupon period for a bond that contains the settlement date of "2017-12-31":

Coupdays( "2017-12-31", [Data].[Date].currentmember.caption, 1, 1 )