Sln (PQL)

Sln (PQL)

Returns the straight-line depreciation of an asset for one period.

- Returned Output: Numeric

- Library: PQL \ Common \ Financial

- Version: 2025.01.000

- Compatibility:

- It can be combined with other PQL functions throughout the application.

- It CANNOT be used with MDX or VBA functions. But it can be used on MDX-based content in other parts of the application.

Syntax

* Click on the function's arguments above for more details on the input values.

Comments

This function is the same as the Microsoft Excel 'SLN' function - using the same inputs, logic, and outputs.

Function Arguments

|

Name |

Description |

Type |

Optional |

|

cost |

Initial cost of the asset. |

<Numeric> |

|

|

salvage |

Value at the end of the depreciation. |

<Numeric> |

|

|

life |

Number of periods over which the asset is being depreciated. |

<Numeric> |

|

Example

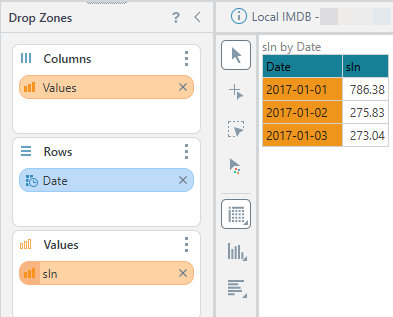

This example calculates the straight-line depreciation of an asset over 12 periods, starting with an initial cost equal to [measures].[Data Sales] and a salvage value (residual value) equal to half of that cost ([measures].[Data Sales]/2). It evenly spreads the depreciation expense across the 12 periods.

Sln( ([measures].[Data Sales]), ([measures].[Data Sales])/2, 12 )